3. Planning and Implementation of Participation with Stakeholders: - The company has established guidelines for creating participation with stakeholders. Including guidelines for sustainability operations to appropriately meet expectations that are different for each stakeholder group. As shown in the table below:

Stakeholders and SDGs

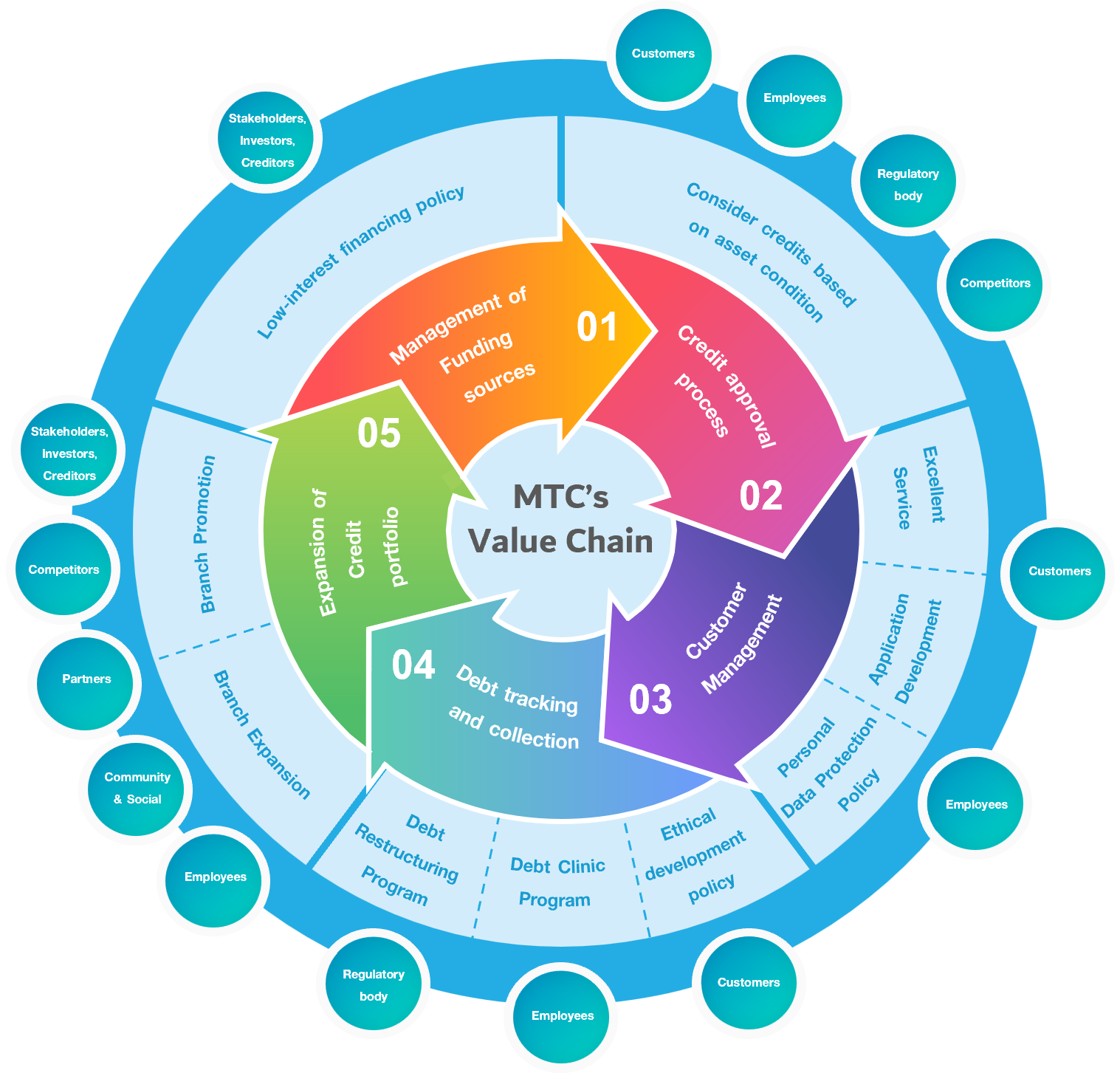

MTC Value Chain

The Company's business operations focus on providing credit services to customers with efficiency. Therefore, stakeholders have been determined based on the value chain, which consists of 5 main processes, namely:

1. Management of funding sources The company has a process for sourcing low-interest funding from multiple financial institutions to adequately support business growth.

2. Credit approval process Loans are assessed through property-based credit assessment methods instead of using customer income or credit bureau data to increase the likelihood of accessing credit sources.

3. Customer managementThere is a policy on the development of industry ethics, including training on procedures for tracking and collecting debts that are correct according to the requirements of relevant agencies. The preparation of the Debt Clinic Project, and the BoT's Fah Som Project to provide customers with financial liquidity and reduce bad debt problems that arise.

4. Debt tracking and collection There is a policy on the development of industry ethics, including training on procedures for tracking and collecting debts that are correct according to the requirements of relevant agencies. The preparation of the Debt Clinic Project, and the BoT's Fah Som Project to provide customers with financial liquidity and reduce bad debt problems that arise.

5. Expansion of credit portfolio There is a process to maintain the existing customer base and increase the new customer base by opening more branches to cover all areas of the country, including upgrading the branch status to support and service customers efficiently.

Stakeholder Engagement

Engaging with stakeholders enables the company to understand their expectations and needs , which helps the company determine issues related to business operations, which is considered one way to drive sustainable development. as well as knowing the impact that the company has on stakeholders. The company has guidelines for managing stakeholders, as follows:

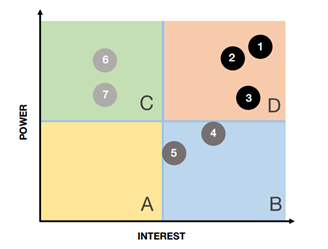

1. Stakeholder identification - The company will consider individuals, groups of people, or agencies that can create an impact or be affected by the organization's operations in various participatory ways, such as dependency, responsibility, and Influence. The company divides important stakeholders into 7 groups as follows:

2. Stakeholder Prioritization - The company prioritizes stakeholders using guidelines for considering their influence and interest in the company's operations. By specifying the stakeholder matrix as follows:

The first 3 groups of stakeholders that the company gives importance to are Customers shareholders/investors/creditors, and Employees/Executives/Board of Directors.

| Stake- holders | Approach to Engagement | Fre- quency | Expectations of Stakeholders | Operational Approach / Goals |

|---|---|---|---|---|

1. Customers |

1. Contact Center 1455 2. Branch Offices 3. Social Media 4. Muangthai Capital Application 4.0 5. Customer Satisfaction Survey 6. Complaint Channels 7. Marketing Activities 8. Company Website 9. |

Every day ______________________ Every month ______________________ No specific schedule |

- The fast loan approval process - The approved credit limit is appropriate - Convenient and quick payment options - Reduction in interest rates and fees - Protection of customers' personal information |

- Consideration of ESG through-out the loan approval process - Branch expansion to increase service accessibility - Creating a positive customer experience with excellent, inclusive, and equitable service - Respecting customer satisfaction, rights, and personal information - Comprehensive follow-up on complaints |

2. Shareholders / Investors / Creditors |

1. Annual General Meeting of Shareholders 2. Opportunity Day 3. Communication through the Stock Exchange 4. IR Website 5. IR Contact 6. Complaint Channels |

Once a year No specific schedule |

- Consistent strong performance - Good corporate governance - A stable, transparent organization with sustainable growth |

- Review and adjust strategies to align with the circumstances - Good corporate governance - Tangible and effective risk management |

3. Employees / Executives / Board of Directors |

1. Monthly Executive Meetings 2. Announcements/Orders 3. MTC University 4. Board Meetings 5. Training and Seminar Sessions 6. Employee Satisfaction Survey 7. Complaint Channels |

Every month ______________________ Every quarter ______________________ Every year ______________________ No specific schedule |

- A positive working environment - Fair compensation and benefits - Good relationships among colleagues - A balance between work and personal life |

- Maintain cleanliness and order of the premises - Foster a strong organizational culture - Adhere to human rights principles - Employee development within the organization |

4. Business partners |

1. Site Visit 2. Partner Risk Assessment Survey 3. Procurement Policy 4. Company Website 5. 6. Complaint Channels |

Once a year ______________________ No specific schedule |

- Collaborative efforts to achieve optimal benefits - Standardized evaluation and selection criteria - Set fair payment terms for partners |

- Manage the supply chain with consideration of ESG impacts - Conduct procurement in a fair and transparent manner - Set fair payment terms for partners |

5. Business competitors |

1. Meetings of the Vehicle Loan Industry Association 2. Personal Loan Club Meetings 3. Meetings for Discussion and Exchange of Ideas on Various Topics |

No specific schedule |

- Compete fairly - Promote the industry collaboratively - Cooperate with the vehicle/personal loan associations in adhering to regulatory standards |

- Collaborate with the vehicle loan industry association to promote the industry's advancement |

6. Communities and society |

1. Social Operations |

Once a year |

- Demonstrate responsibility for community health and safety - Consider the social and environmental impacts - Strictly comply with the law |

- Foster engagement between the company and the community through social projects - Conduct business with care for society and the environment |

7. Regulatory authorities (Bank of Thailand / Office of the Consumer Protection Board / Public Debt Management Policy and Supervision) |

1. Meetings/Feedback Sessions 2. Coordination with Authorities 3. Site Visit 4. |

No specific schedule |

- Support policies and comply with established regulations appropriately - Transparent management - Improve operations to align with set standards |

- Continuously cooperate with regulatory authorities |

Sustainable Materiality

Comprising of the following 4 steps:

Identification Review of 2023 sustainability issues. Compare with international sustainable issues. Consider the issues that affect all the stakeholders. Discuss the issues with the relevant stakeholders.

Prioritization Analyze and consider information gathered from discussions with all stakeholders, prioritizing sustainability issues based on their impact on the company and stakeholders.

Validation Summarize the priorities of sustainability issues for the executive committee to consider the accuracy of sustainability issues. For acknowledgement and comments to bring sustainability issues to the public.

Review Review processes and key sustainability data after publishing the report to all stakeholders to receive their opinions and suggestions for further improvement of the report.

Materiality Assessment Result

Governance

1.

Good Corporate Governance and Business Ethics

2.

Innovation Development and Digital Transformation

3.

Risk Management

4.

Data Protection and IT Security

5.

Supply Chain Management

6.

Promotion of Financial Accessibility

7.

Responsible Lending

Social

8.

Financial Literacy

9.

Human Rights

10.

Employee Well-being

11.

Employee Skill Development

12.

Customer Relationship Management

13.

Occupational Health and Safety

14.

Community and Social Development

Environment

15.

Climate Change

16.

Efficient Resource Utilization

17.

Biodiversity

Sustainability Performance 2024

The Company has identified 17 important issues and goals for sustainable development as follows:

Sustainability Issues

| Sustainability issues | Stakeholders | Impact level |

Impact on Stakeholders |

Approach to Address Sustainability Issues |

Related Risks | SDGs | GRI |

|---|---|---|---|---|---|---|---|

1. Good Corporate Governance and Business Ethics |

Customers Shareholders/Investors/Creditors Employees/Executives/Board of Directors Partners Business Competitors Communities and Society Regulatory Authorities |

High |

- Operating under good governance principles reduces corruption and builds stakeholder trust |

- Operate transparently and fairly to build investor confidence |

Sustainability Risks |

|

GRI 2-13 |

2. Innovation Development and Digital Transformation |

Customers Employees/Executives/Board of Directors Partners Business Competitors Regulatory Authorities |

low |

- Enhance competitiveness and adaptability to changes

|

- Develop new products and services

|

Strategic Risks

|

|

- |

3. Risk Management |

Customers Shareholders/Investors/Creditors Employees/Executives/Board of Directors Partners Business Competitors Communities and Society Regulatory Authorities |

High |

- Achieve goals with plans to manage and reduce the impact of unforeseen events.

|

- Identify risks across all dimensions.

|

Operational Risks

|

|

GRI 2-12 |

4. Data Protection and IT System Security |

Customers Shareholders/Investors/Creditors Employees/Executives/Board of Directors Partners Regulatory Authorities |

High |

- Personal data is effectively managed.

|

- Implement data leakage prevention measures

|

Sustainability Risks

|

|

GRI 2-12

|

5. Supply Chain Management |

Employees/Executives/Board of Directors Business Partners |

Low |

- Prevent disruptions in business operations

|

- Conduct comprehensive

risk assessments for partners

|

Sustainability Risks

|

|

GRI 2-6

|

6. Promoting Financial Accessibility |

Customers Employees, Executives, and Board of Directors Community and Society |

Med |

- Expand opportunities for access to financial services

|

- Set a target to expand at least 600 branches per year

|

Financial Risks

|

|

GRI 203 |

7. Responsible Lending |

Customers Community and Society |

Med |

- Support sustainable debt relief measures

|

- Provide assistance to customers facing financial difficulties

|

Financial Risks

|

|

GRI 2-23 |

8. Financial Education |

Customers Community and Society |

Low |

- Help customers develop financial discipline

|

- Communicate financial management education through various company channels |

Financial Risks

|

|

GRI 203 |

9. Human Rights |

Customers Shareholders/Investors/Creditors Employees, Executives, and Board of Directors Business Partners |

High |

- Reduce conflicts that may impact business operations

|

- Establish human rights policies

|

Sustainability Risks

|

|

|

10. Employee Well-being |

Employees/Executives/ Board of Directors |

Med |

- Provide a conducive work environment that supports effective performance

|

- Plan personnel and equipment allocation to support branch expansion

|

Operational Risks

|

|

GRI 2-6

|

11. Employee Capacity Development |

Employees/Executives/Board of Directors Regulatory Authorities |

High |

- Promote efficient operations

|

- Provide training to enhance knowledge for employees at all levels

|

Operational Risks

|

|

GRI 403

|

12. Customer Relationship Management |

Customers Employees/Executives/Board of Directors |

High |

- Retain existing customers and attract new ones

|

- Establish a process for hand

|

Operational Risks

|

|

GRI 3-3 |

13. Occupational Health and Safety |

Customers Employees/Executives/Board of Directors |

High |

- Reduce issues related to operational continuity

|

- Promote safety through training and education

|

Operational Risks

|

|

GRI 403 |

14. Community and Social Development |

Community and Society |

Med |

- Improve the well-being of the community

|

- Implement projects to promote the well-being of the community |

Sustainability Risks

|

|

GRI 201 |

15. Climate Change |

Customers Investors/Shareholders/Creditors Employees/Executives/Board of Directors |

High |

- Reduce greenhouse gas emissions from company activities

|

- Develop a budget for damage mitigation

|

Sustainability Risks

|

|

GRI 201

|

16. Resource Efficiency |

Employees/Executives/Board of Directors Community and Society |

Low |

- Help reduce operational costs

|

- Implement projects to promote the reduction of greenhouse gas emissions in company operations |

Sustainability Risks

|

|

GRI 302

|

17. Biodiver-sity |

Customers Community and Society |

Low |

- Create positive impacts through branch expansion

|

- Establish criteria for selecting locations for branch expansion that do not impact or harm the ecosystem |

Sustainability Risks

|

|

GRI 304 |