Muangthai Capital Public Company Limited is determined to become a world-class organization by formulating risk management strategies that are in line with international guidelines and practices covering the entire financial business group to grow the business and generate stable returns.

Enterprise risk management

Enterprise risk management

The importance of risk management

- Create a knowledge base that is useful for management and operations.

- Reflects an overview of various important risks.

- It is an important tool for management to plan and manage properly.

- To develop the organization effectively.

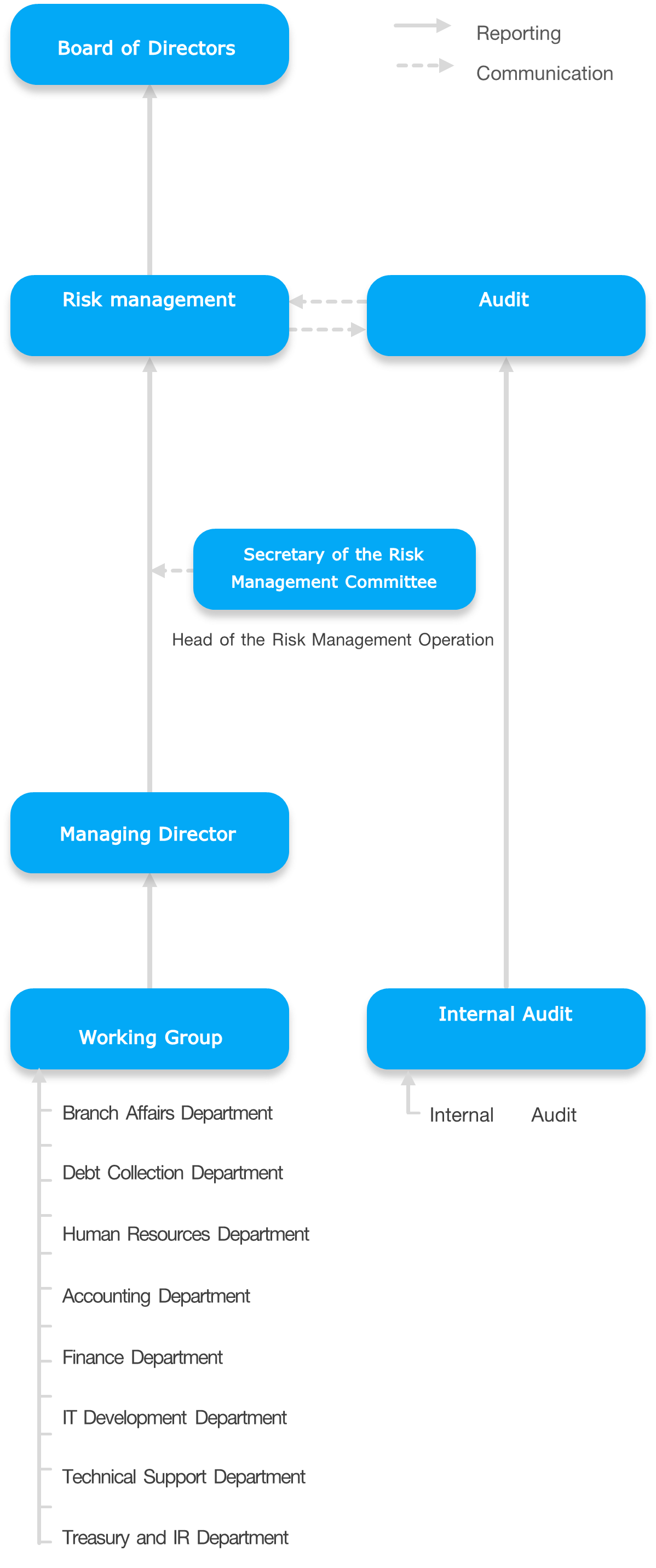

Risk management structure

The company has a risk management structure that is internationally accepted, defining the roles and responsibilities of the Risk Management Committee as well as related committees. At present, there are reports to the Risk Management Committee in dual reporting at least twice a year. In addition, there is an internal audit department that performs duties independently, and the executives set up a regulatory compliance department to make risk management more concise and use the concept of risk management to supervise the company to achieve success according to the strategic plan. The roles and responsibilities of the Board of Directors must look at the overall picture of corporate governance, risk management, and regulatory compliance (Governance, Risk, and Compliance, GRC) to drive the organization toward sustainability with value and promote efficiency in operations.

The board of directors

Approve the risk policy and acceptable risk scopes

Govern and monitor the risk management, ensuring compliance with and practice the policy efficiently and continuously.

The Risk Management Committee

Review a report of the risk management to be on an acceptable level.

The Audit Committee

Proceeds an independent review, ensuring that the risk management is conducted effectively.

Secretary of the Risk Management Committee

Proposes a policy, strategic plans and specifies key risks.

Coordinates with the Board or related parties.

Reports the risk management to the Risk Management Committee on a semi-annual basis.

The Executives and employees

Manage and report risks to executives in daily operations.

Working Group

Proposes a policy and strategic plans to the Managing Director.

Implement approved risk management policies and guidelines into practice within responsible department.

Promote a risk management and internal control culture within responsible departments.

The Internal Audit Department

Proceeds a review to ensure that the internal control is conducted appropriately and continuously.

Plans an audit following the risk factors.

Coordinates with the working groups to exchange risk information which may affect the Company.

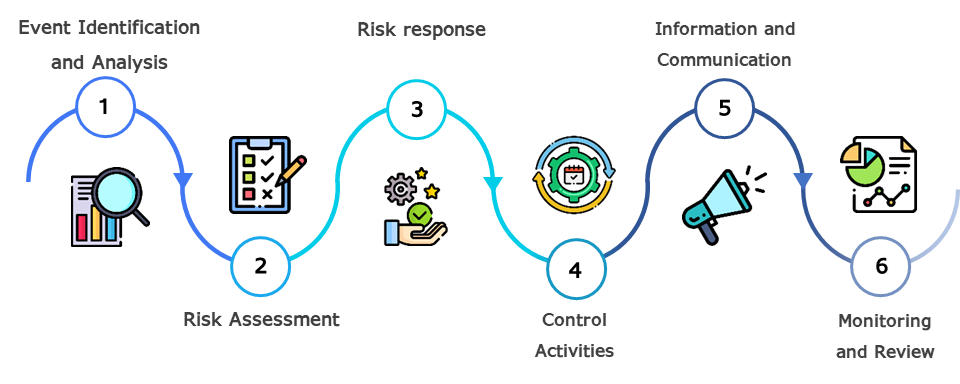

Risk Management Process

1. Event Identification and Analysis

The procedure for understanding the causes of risk exposure identifies events or process activities that may lead to failure, damage, and non-achievement of the organization's objectives or goals to clarify the risk identification. The company, therefore, classifies all 10 types of risks as follows:

- Strategic Risk

- Operation Risk

- Healthy Risk

- Policy and Compliance Risk

- Financial Risk

- Environment Risk

- Community Risk

- Image and Reputation Risk

- Emerging Risk

- Project Risk

กระบวนการระบุและวิเคราะห์ความเสี่ยง

- Workshop

- Risk Self-Assessment

- Benchmarking

- Brainstorming

- Key Risk Indicator : KRI

- Loss Report

- Action Plan Analysis

2. Risk Assessment

It is a damage assessment due to risks, consisting of two dimensions: namely, 'likelihood' and 'impacts,' with the following considerations:

| Level | “Likelihood” | Frequency |

|---|---|---|

|

1 |

Highly unlikely |

Every 6-12 month |

|

2 |

Unlikely |

Every 3-6 month |

|

3 |

Possible |

Every 1-3 month |

|

4 |

Likely |

Twice a week |

|

5 |

Highly likely |

Once a week |

| Level | “Impacts” | Detail |

|---|---|---|

|

1 |

Lowest |

Damage value < 50,000 baht |

|

2 |

Low |

Damage value > 50,000 baht |

|

3 |

Medium |

Damage value > 200,000 baht |

|

4 |

High |

Damage value > 500,000 baht |

|

5 |

Highest |

Damage value > 1,000,000 bath |

Take into account the risk assessment table as shown below.

| Risk assessment | Possibility of risk to the organization | |||||

|---|---|---|---|---|---|---|

|

Impacts |

5 |

5 |

10 |

15 |

20 |

25 |

|

4 |

4 |

8 |

12 |

16 |

20 |

|

|

3 |

3 |

6 |

9 |

12 |

15 |

|

|

2 |

2 |

4 |

6 |

8 |

10 |

|

|

1 |

1 |

2 |

3 |

4 |

5 |

|

|

1 |

2 |

3 |

4 |

5 |

||

|

Likelihood |

||||||

| Probability | Risk level | Guidelines |

|---|---|---|

|

0-4 |

Low |

No additional management. |

|

5-9 |

Medium |

Prevent risk from moving to a high level. |

|

10-15 |

High |

Manage risks to keep them at acceptable levels. |

|

16-25 |

Critical |

Managing risk to an acceptable level urgently. |

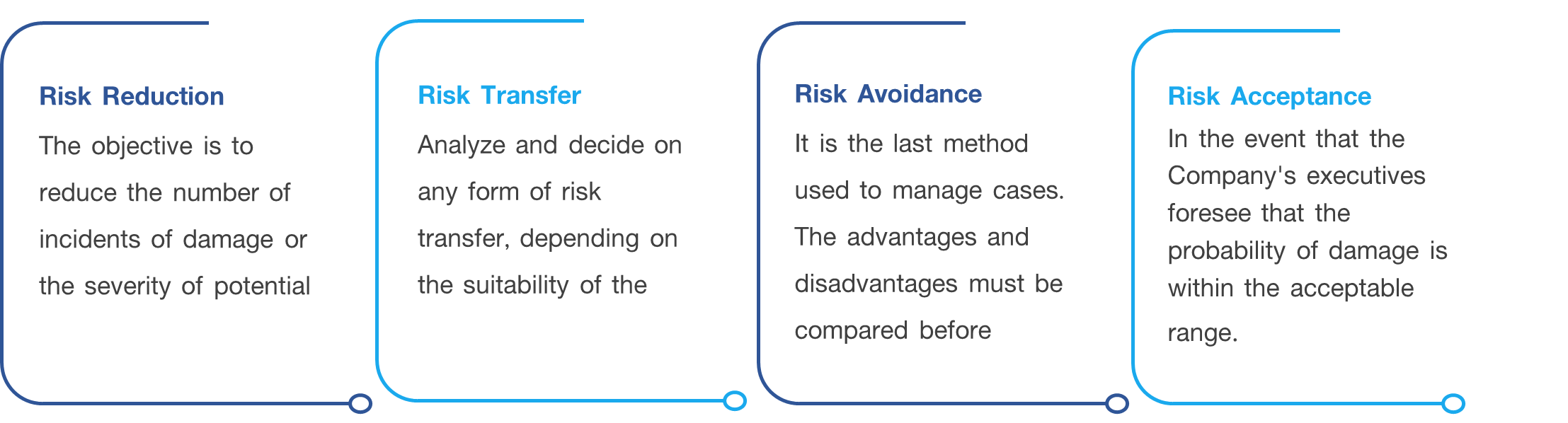

3. Risk Response

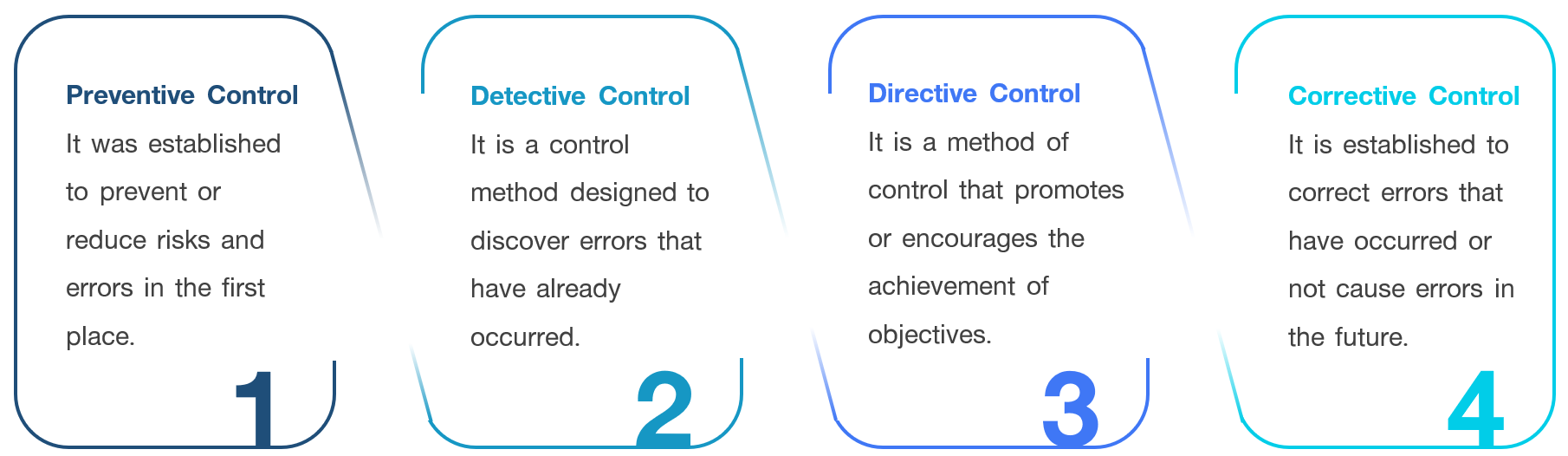

4. Control Activities

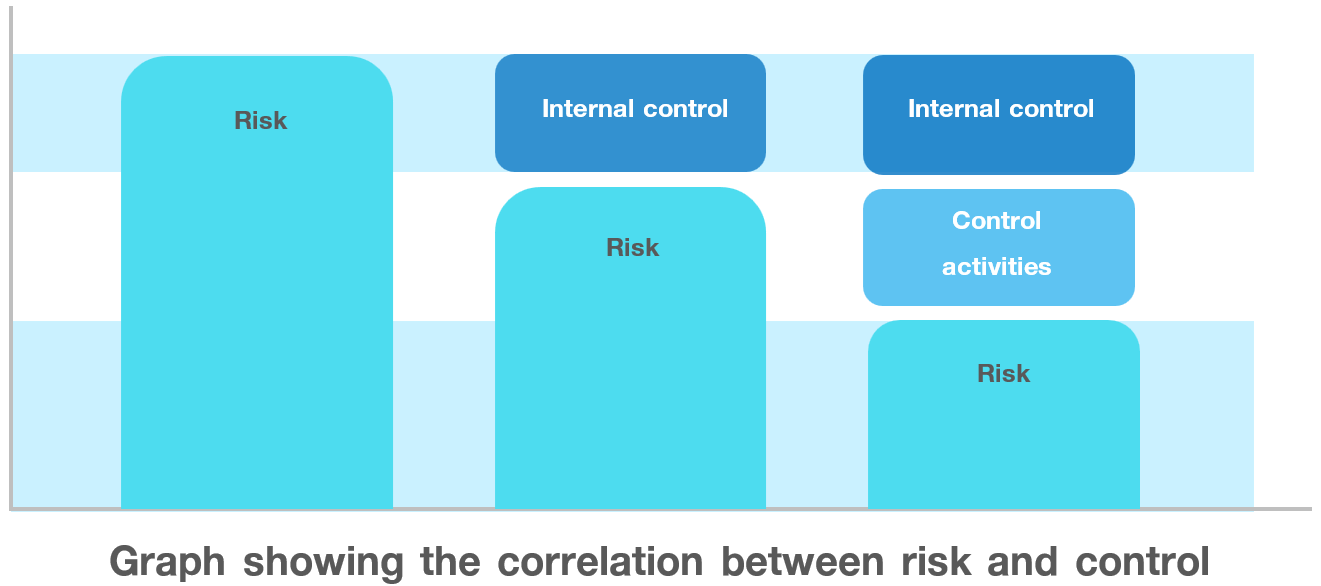

Once appropriate risk response methods have been selected, risk control activities are established to ensure that risk is properly managed. In all aspects of the operation, there must be adequate control activities that are appropriate for the type of control which can be grouped as follows:

The picture shows the relationship between risks and control activities, in addition to adequate internal control. Establishing additional risk control activities can also help reduce the level of risk to an acceptable level.

5. Information and Communication

Information and communication systems will be tools that management can use to convey governance policies and monitor the success of operations. Organizations must have effective information and communication systems. A good information system should consist of the following:

- User rights are controlled and categorized based on responsibilities and types of tasks.

- A data backup system is in place to prevent system failures or unforeseen events that may impact critical data.

- There is a functioning system that facilitates inter-departmental collaboration, enabling effective information management across departments.

- There is a backup facility equipped with the necessary equipment and systems to enable essential agencies to resume operations immediately in case of emergencies such as fires or building collapses.

- An asset management system is implemented to meet user needs without unnecessary complexity, thereby facilitating smooth operations.

6. Monitoring and Review

The Risk Management Committee organizes regular meetings to review the organization's risk management, convening at least twice a year. Meeting participants include members of the Risk Management Committee, secretaries, executives, and relevant departments to assess guidelines, modify and enhance policies and guidelines for risk management, ensuring alignment with the company's internal and external environment. At the board level, follow-ups focus on risk issues that could significantly impact the company, posing severe and unacceptable risks that may affect operational results or the direction of the company's activities.

Risk management performance

To foster a culture of risk management within the organization, the company has revised its risk manual to enhance clarity and relevance across various organizational contexts. Additionally, executive-level risk training sessions have been organized to impart knowledge and understanding of risk management principles, ensuring alignment with the company's risk manual. Moreover, each department is encouraged to take ownership of its risk management processes, from identifying risk issues to ongoing monitoring and evaluation. The company also provides a platform for employees to express opinions and suggestions regarding the risk management process, which serves as a guideline for enhancing operational efficiency. The Secretary of the Risk Management Committee is tasked with summarizing results and communicating them to the committee during biannual meetings, thereby ensuring effective oversight and alignment with organizational objectives.

In 2024, the Risk Management Committee held three follow-up meetings and discussed risk issues, with important meeting agendas summarized as follows:

- Considered and acknowledged progress in controlling and solving risk problems.

- Considered and approved the revised edition of the risk management manual.

- Considered and approved the Risk Management Committee Charter.

- Considered and approved new risk rankings.

Business continuity management

The company has established a Business Continuity Management (BCM) Policy and Strategy Committee, comprised of executives from various departments, with the Managing Director serving as chairman. This committee is responsible for setting the company's business continuity strategy and policy, as well as allocating resources to support operations, monitoring progress, and overseeing the overall picture of business continuity management. The organization has reviewed the operational plan for preparing a plan to deal with risks and events that may occur in the future, such as disasters, natural disasters, epidemics, sabotage, etc., in order to return business operations to normal as soon as possible. Examples of the company's operational plans and response guidelines include:

-

Spread of infectious diseases:

Since the outbreak of the COVID-19 disease, the company has established prevention plans and measures to deal with various epidemics that may occur in the future. These include:

- Monitoring, evaluating, and closely following up on various epidemic situations from the Ministry of Public Health.

- Conducting risk screening for employees and preparing special work locations for this group.

-

Disruption in the information technology system:

To prepare for and cope with various events that may cause damage to the information technology system from both internal and external factors, the company has established guidelines for preparation and response as follows:

- Prepare a policy and procedures manual to provide guidelines and principles for employees.

- Conduct emergency information technology system recovery plan drills twice a year to prepare employees and provide coping guidelines.

The company's risk performance

| Risk issues | Impacts | Level of impacts | level of chance | Risk management plan | Performance | ||

|---|---|---|---|---|---|---|---|

| KRI | Target | Result | |||||

|

1. Labor shortage |

Lack of sufficient personnel to support Company growth. |

5 |

1 |

Create motivation and promote a positive work environment for employees |

Employee Turnover Ratio Compared to New Hires. |

Ratio not exceed 1 |

Ratio 0.53 |

|

2. Corruption |

The Company's image and investor confidence. |

4 |

5 |

Training to develop moral and ethical values for employees. |

Number of corruptions |

0 cases |

0 cases |

|

3. Incompliance with regulations, orders, laws or principles of regulators |

Inconsistent operations across the organization. |

4 |

5 |

Training for new employees and provide consultation channels regarding regulations. |

Average KPI of audited branches. |

Not less than 85% |

88.52 % |

|

4. Competition and new competitors |

Performance not meeting targets. |

5 |

4 |

Establish a strategic plan to maintain leadership in the business |

Maintain No.1 of the portfolio ratio in the market. |

No. 1 |

No. 1 |

|

5. Increasing domestic interest rates |

Increase of financial Cost |

5 |

3 |

Provide alternative funding sources and adjust interest rates upward. |

Average annual interest rate. |

Not exceed 4.2% |

4.13 % |

|

6. Funding from financial institute |

Suspension of credit line usage and non-approval of new credit lines. |

5 |

3 |

Regularly assess and monitor financial ratios. |

D/E Ratio |

Less than 4 times |

3.62 |

|

7. Liquidity |

Delay in loan disbursement and branch expansion. |

5 |

1 |

Establish an appropriate funding plan. |

The ratio of cash inflows to outflows. |

More than 1 |

1.58 |

|

8. Expansion of new branches |

The unworthiness of opening branches impacts operational performance. |

4 |

5 |

Review and revise business plan to suit each area |

The ratio of cash inflows to outflows. |

Not less than 14.5 |

20.1 |

|

9. Increase of NPL |

Decrease of net profit. |

4 |

5 |

Reduce providing loans to a group of high-risk customers and sell NPL to other company |

Ratio of default on debt payment / portfolio in total |

Not exceed 3.5% |

2.75 % |

|

10. Disaster |

Operation is discontinued |

3 |

1 |

Set a remedial compensation. |

Number of events |

Not exceed 280 cases |

293 cases |

|

11. regulations from external agencies |

Illegal and lack of investor confidence. |

5 |

1 |

Continuously monitor and review the regulations or requirements set by the Company's regulatory authorities. |

Percentage of Compliance with Regulatory Authorities. |

100% |

100% |

|

12. Cyber threats and data theft |

Violate the PDPA and lose the creditability. |

5 |

1 |

Adopt advanced technologies within the organization. |

Number of attacked |

0 cases |

0 cases |

|

13. Loss of image and reputation (impersonation) |

Misunderstand of the Company’s image and customers lose their assets. |

1 |

5 |

Create warning contents of scammer by online and offline channel |

Number of submitting questions and complaints by customers (cases/quarter) |

Not exceed 120 (cases/year) |

14 cases |

|

14. The delay in the break-even point in some branches |

The results did not meet the target. |

4 |

5 |

Review and adjust the business plan of each area. |

Ratio of Loan recrivable per branch |

Not less Than 14.5 |

19.02 |

|

15. Increasing domestic product prices |

Increase of the Company's operating costs |

4 |

1 |

Set an expense ceiling and source alternative partners. |

The ratio of the average price per unit compared to the overall primary price per unit. |

Increase by no more than 4% |

Decrease 0.58 |

|

16.Occupational health and safety |

Operation is discontinued and lack of employees at branches |

2 |

3 |

Promote safety activities and provide equipment such as helmets |

Number of incidents in working hours |

0 cases |

74 cases |

|

17. Bond repayment capability |

The Company's image and investor confidence. |

3 |

1 |

Regularly assess the Company's bond repayment capacity. |

The number of bond default events. |

0 cases/year |

0 cases |

|

18. Inefficiency service |

Unable to maintain the customer base. |

1 |

5 |

Training and providing consultation on proper customer service methods. |

Customer satisfaction (percentage). |

More than 80% |

82.35 % |

|

19. Carbon tax (Emerging Risk) |

Increased operational costs. |

2 |

1 |

Reduce greenhouse gas emissions from organizational operations. |

Expenses due to carbon tax. |

No charge |

0 Baht |

|

20. Failure to meet the company's GHG emissions targets (Emerging Risk) |

Loss of investor confidence and lack of credibility. |

2 |

2 |

Closely monitor the organization's performance and initiate projects aimed at reducing greenhouse gas emissions. |

Amount of carbon dioxide emission (tonCO2/year) |

Not exceed 10% (YoY) |

8.02% increase |

Risk Analysis

1. Lack of Employee

With the goal of expanding branches nationwide, recruiting enough staff for the branches to support business growth may impact operations. Additionally, the microfinance sector is facing increased competition, making recruitment even more challenging. The Company also faces the challenge of retaining experienced and skilled employees to stay within the organization.

The Company has planned to recruit enough staff to support its growth and has established initiatives to develop employees' potential, create opportunities, and motivate them to perform well. It also promotes career advancement and job security, offering competitive compensation and benefits. This is achieved through skill development programs and continuous learning support, along with effective performance evaluation criteria. The Company has set a target for the employee turnover ratio, with new hires not exceeding the number of employees leaving by more than 1:1. In 2024, the Company achieved a ratio of 0.53 which is within the acceptable range.

2. Corruption and Corporate Governance

Good corporate governance is a system that demonstrates the ability to manage effectively. Without transparent management, it impacts the trust of all stakeholders. The company upholds ethics and transparency as core principles in its operations, recognizing the risk of corruption and taking steps to prevent such incidents within the organization. Measures to reduce potential risks include anti-corruption policies, a gift policy, and a complaint handling policy, all of which are disclosed to stakeholders.

Furthermore, the company regularly reviews the causes of fraud and corruption, seeking preventive measures through effective internal controls and risk assessments at each stage of operations. If any employee is found to have engaged in corrupt activities, the company enforces strict disciplinary actions, including the highest penalties. Employees are trained to foster a culture based on integrity and honesty, which is fundamental in building trust with customers and stakeholders. The company is also a member of the Private Sector Collective Action Against Corruption (CAC) and encourages its partners to join the CAC network, ensuring ongoing transparency and collective responsibility. In 2024, the company recorded zero incidents of corruption.

3. Regulations, including laws and regulations within the Company

Failure to follow the Company’s regulations, orders, or guidelines, due to insufficient knowledge or understanding of these guidelines, or outdated manuals, can lead to operational errors. This indicates inefficiencies in management and may result in a loss of stakeholder confidence.

The Company has established clear regulations and operational standards for both employees and management to follow strictly. Adequate internal controls and oversight processes are in place, with regular training to ensure employees have a clear understanding of the operational guidelines. Policies are implemented, and operational manuals are regularly reviewed for accuracy. Performance is measured through branch KPIs. In 2024, the branch KPI reached 88.52%, an increase from 2023, exceeding the 85% target.

4. Competition and New entrants

Currently, many new microfinance service providers have emerged, leading to increased competition in the industry. This includes product development that best meets customer needs, accessible interest rates, and excellent service quality, all of which impact customer satisfaction and loyalty, helping to retain existing customers and attract new ones. The company must adapt to the competition and regularly review its strategies and operational plans to cope with changes and challenges in the increasingly competitive lending industry.

In addition, the Company is focused on growth by expanding into new customer segments through branch expansion across all areas, with the aim of increasing financial inclusion while maintaining its existing customer base. The Company ensures regular customer satisfaction monitoring to respond to the ever-evolving needs of its clients. In 2024, the Company remained the number one leader in the microfinance business. Moving forward, the company is committed to continuous development and striving to become a global leader in the microfinance sector.

5. Increase of domestic interest rates

The increase in domestic interest rates impacts operational costs, as market fluctuations could lead to higher borrowing costs for the Company. Currently, the Company is offering loans at interest rates below the legal limit set by the Bank of Thailand. However, if financial costs or other liabilities rise in the future, the Company will consider adjusting its interest rate ceiling accordingly. Additionally, the Company has diversified its funding sources by issuing bonds, obtaining financing from both domestic and international sectors, thereby reducing the risk from domestic interest rate hikes.

In 2024, the Company entered into a funding agreement with a credit line exceeding 142 million USD in collaboration with two global financial institutions: the Bank of China (BOC) and the International Finance Corporation (IFC), a member of the World Bank Group.

6. Obtaining funding from financial institutions

Capital is a key factor in the expansion of the lending business. Over-reliance on funding sources, particularly commercial banks, can pose risks from excessive dependence on a single financial institution. Additionally, industrywide changes can impact the lending policies of smaller financial institutions, which may become a limitation in obtaining loans for the Company.To diversify risk, the Company has developed a funding plan from both domestic and international financial institutions to reduce financial costs and maintain liquidity. The Company uses various funding sources, such as issuing debentures and borrowing from domestic and international banks, to ensure a suitable financial structure and stability in operations. The Company also continuously improves and develops its funding plan.

7. Financial Liquidity

The Company places significant emphasis on liquidity management. If it is unable to convert assets into cash in a timely manner or secure sufficient funding sources, it may face difficulties in meeting debt obligations, which could lead to financial problems and negatively affect investor and creditor confidence in the long term. Moreover, the Company has developed a liquidity control and management plan to ensure sufficient Cash Flow for both regular operations and crisis situations. This includes cash flow reports, liquidity ratio analysis, and an appropriate funding strategy. In 2024, the Company's cash flow ratio was 1.58, in line with the Company's targets.

8. Branch Expansion Profitability

Expanding branch coverage nationwide is a key factor in increasing access to financial services and driving the Company's growth toward its goals. However, opening new branches also presents risks related to cost-effectiveness. Without effective management, this could impact business performance and investor confidence. The Company rigorously analyzes and plans branch openings through on-site surveys, assessing population density, target customer groups, performance of nearby branches, and key financial metrics. These include Payback Period and Return on Investment (ROI), which must not fall below the defined thresholds. Additionally, strategies for acquiring new customers are continuously refined to enhance branch operational efficiency. The Company has set a minimum loan portfolio per branch at 14.5 million Baht. In 2024, the loan portfolio per branch reached 20.1 million Baht, with a continued upward trend each year.

9. Rising Non-Performing Loans (NPL)

If debtors fail to make payments as scheduled, the Company will lose its primary revenue from interest and may partially or entirely lose the principal amount. This will impact profitability and hinder business growth. To minimize the risk of NPL, the Company maintains regular debt collection monitoring and implements the MTC Model, a key tool for enhancing systematic debt management efficiency. Additionally, the Company transfers uncollectible debt to asset management firms specializing in distressed assets, mitigating the risk associated with debt recovery. As a result, in 2024, the NPL ratio stood at 2.75%, lower than the targeted 3.0%.

10. Natural disasters

Natural disasters are increasing and may cause significant losses to individuals, property, the economy, and the environment. In 2024, the Company raised awareness about climate change among employees and updated its Business Continuity Plan (BCP) to align with real-world situations. A budget of 5 million Baht was allocated to mitigate potential impacts. Last year, no significant disasters occurred.

11. Regulations by external authorities

As a credit provider operating under regulatory, the Company must comply with regulations and rules set by various authorities, which may change at any time. Failure to fully comply or partial compliance could damage the Company’s reputation and credibility, potentially leading to fines or even the revocation of its license, which would severely impact future operations. Risks from regulations by external authorities The Company continuously reviews and monitors external legal regulations to ensure business compliance. It conducts annual training and testing for employees on regulatory matters, with a legal oversight department reporting to the board and executives twice a year. In 2024, there were no legal disputes.

12. Cyber threats and data theft

Currently, technology is developing rapidly, leading to cyber threats that cause damage and impact all sectors. These threats may come in new forms that are difficult to detect. As customer data storage and management systems are now digital, the company has established a secure and efficient network infrastructure. This is supported by strict policies and measures for information security, as well as regular training for staff to keep up with technological changes. Additionally, external audits are conducted annually. In 2024, the Company did not encounter any incidents related to information security or personal data breaches, which aligns with the Company's objectives.

13. Loss of image and reputation

Currently, there has been a significant increase in fraudulent activities, with individuals impersonating the Company and falsifying important communication channels, leading to misunderstandings and potential financial harm to customers. To address this, the Company regularly publishes online media through various channels once or twice a month. Additionally, the Company issues alerts about potential fraud through its communication platforms and monitors the number of related complaints. A target has been set to ensure that the number of such complaints does not exceed 120 per year. In the past year, there were 14 complaints related to this issue, which aligns with the Company's target.

14. Robbery

Due to the Company's extensive network of over 8,171 branches nationwide, including in rural areas, there are vulnerabilities that could lead to theft, affecting both life and property, and disrupting services. To mitigate this, the Company has implemented theft prevention measures, such as secure cash handling, document storage, surveillance cameras, and regular checks. The acceptable limit for such incidents is no more than 12 per year, with damages not exceeding 240,000 Baht. In 2024, there were 7 theft incidents with damages totaling 113,489.26 Baht, within the acceptable limit.

15. Increasing domestic interest rates

The increase in product prices has impacted operational costs. Therefore, the Company focuses on managing and mitigating risks to keep business costs at an acceptable level. This is achieved by preparing an annual budget, monitoring product prices, and planning for price increases using bulk buying strategies to maintain quality and control expenses. Additionally, the Company secures backup suppliers in case product prices exceed expectations. The average unit price compared to the acceptable benchmark price has increased by no more than 4%. In 2024, the Company successfully reduced the average product price by 0.58%, which is below the target, providing a cost advantage in the Company's operations.

16. Occupational Health and Safety

Accidents caused by unforeseen circumstances can result in harm to the safety of employees' lives and property, potentially disrupting operations and affecting business continuity. Therefore, the Company prioritizes the welfare of its employees by implementing policies related to occupational health, safety, and the work environment. The Company also promotes safety and occupational health through various channels within the organization to minimize workplace accidents. In 2024, there were 74 reported accidents.

17. The ability of debenture debt repayment

The Company has continuously issued debentures to use as working capital for business operation to support the expansion of the Company’s business and to be used for repayment of debentures or bills of exchange. It is also used as working capital of the Company. The inability to repay debts on time would inevitably damage the Company's image and investor confidence. The Company has established a regular monitoring and assessment process to evaluate its ability to repay bonds, ensuring no default events occur. It also considers setting appropriate interest rates for new bond issues. Over the past three years, in 2024, the Company had no history of bond defaults, leading to a long-term domestic credit rating of 'A-(tha)' with a stable outlook from Fitch Ratings.

18. Providing inefficient services

Customers are one of the key stakeholders of the Company. Providing inefficient services can negatively impact the business in various ways. Not only does it prevent us from retaining existing customers, but it also causes us to lose opportunities for expanding our customer base to new groups. The ability to satisfy customers is crucial for our progress and sustainable growth in a highly competitive market. The Company provides training to employees to enhance service quality based on the principle of "Intimate services like closed family members." Customer feedback and complaints are used to improve operations, with a target customer satisfaction of at least 80%. In 2024, the satisfaction rating reached 82.35%, surpassing the target. The Company is committed to continuously improving service standards for maximum customer satisfaction.

19. Carbon tax (Emerging Risks)

Many countries have started implementing carbon taxes, and Thailand is another country that cannot avoid this. The Excise Department is preparing to announce the implementation of carbon tax measures, which, if enforced, may increase the company's operational costs and expenses. The Company is preparing a response plan by conducting awareness campaigns on resource usage for employees at all levels through various channels. Additionally, data on resource usage is collected monthly for monitoring and analysis, which will be used to adjust measures accordingly. The target is to limit the carbon footprint increase to no more than 10% compared to the previous year. In 2024, the increase was 8.02%

20. failing to achieve the organization's Greenhouse gas emission targets (Emerging Risks)

Greenhouse gas emission targets are a global agenda that all sectors, including investors, prioritize. Investors can choose to invest in businesses that are responsible and committed to addressing climate change. Organizations that fail to meet their established greenhouse gas emission targets may lose investor confidence. Therefore, it is crucial for companies to closely monitor their operations. In 2024, the Company is committed to reducing greenhouse gases by setting clear targets and a systematic action plan as follows:

- Enhancing climate change operations in line with the TCFD (Task Force on Climate-Related Financial Disclosure) standards, setting goals and strategies for reducing carbon footprints in the short, medium, and long term.

- Initiating a solar power project by piloting the installation of solar panels on the rooftops of 5 branch office buildings in Phitsanulok and Sukhothai province.

- Starting a project to set electricity usage limits for office buildings to raise awareness and reduce electricity consumption at branch offices.

- Participating in the “Care the Bear” program by the SET to reduce greenhouse gas emissions from organizing the Company's mid-year seminar in 2024.