Business Innovations

Business innovation development is one of he driving forces for business growth and competitiveness. he company is committed to creating innovations to improve the quality of life in society while simultaneously striving to grow the business with minimal environmental impact.

Guidelines

- Establish an innovation development unit for products and services, listening to the opinions of stakeholders to review and develop innovations.

- Promote corporate values and culture that encourage employees to be creative.

- Promote innovation development that creates value for the business, economy, society, and the environment.

Creation of innovation for sustainability

“Solar Cell Loan” Product

The company introduced the "Solar Cell Loan"as an extension of its flagship product, the Pay Later Loan, aimed at fostering and facilitating access to clean energy on a household level. This initiative aligns with our commitment to expanding our product portfolio to comprehensively cater to the diverse needs of our customers while also promoting sustainability and environmental responsibility. The solar cell loan not only offers asustainable solution but also promises long-term cost savings. With a credit limit of up to 40,000 baht, customers have the flexibility to repay the loan over a period ranging from 6 to 60 months.

In 2024, the company issued loans totaling 1.98 million Baht, an increase of 6.45% from the previous year. This initiative also contributed to a reduction in greenhouse gas emissions by 182 tonCO2e, reflecting a 7.06% increase.

Developing the application of Muangthai 4.0

The Muang Thai 4.0 application has been designed to better address the issues and needs of customers in the digital age, providing greater convenience. Features include:

- Checking contract information and outstanding balances.

- Special offers for customers to adjust contracts and apply for personal loans.

- Paying installments via QR Code, through the banking app, and PromptPay.

- Checking past payment history with electronic receipts.

- Presenting other products, as well as providing information about nearby branches.

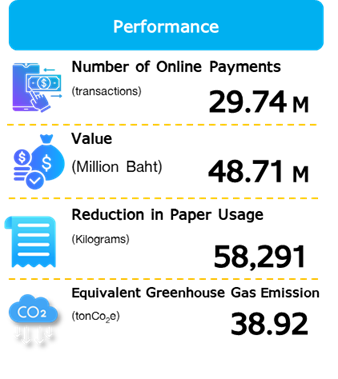

Online payment methods help reduce paper usage from issuing receipts. The company collaborates with commercial banks to expand cross-bank bill payment channels. Additionally, customer feedback is regularly used to improve the application’s functionality, ensuring more convenience for users. The app also introduces new marketing channels by updating special offers, making it easier for customers to access these promotions.

Online Payment and Electronic Receipt (E-Receipt) Services

Currently, technology has influenced customer behavior, leading to changes in lifestyle in line with modern times. The company must adapt to remain competitive, which is why it has introduced additional online payment options and the delivery of electronic receipts via SMS and email. This initiative aims to provide convenience, reduce paper usage, and minimize unnecessary travel.

The company has set a target to increase the proportion of online payments, aiming for 25% of total payments to be made online by 2025. To encourage more customers to adopt online services, employees at branch locations provide guidance, and the company utilizes communication channels to promote the service. This has led to the development of a transaction notification system, allowing customers to easily stay updated with the latest news and information.

Online Accident Insurance Sales

The company places great importance on developing a variety of services and products that meet customer needs by gathering feedback and suggestions from various channels. These are reviewed and used to improve services, aiming to comprehensively respond to customer demands.

In the past year, the company launched an online personal accident insurance service through its website, in collaboration with an insurance company and the information technology department. The system was developed and designed to offer a platform for purchasing personal accident insurance online, providing a convenient way for customers to buy insurance with a secure, cost-effective payment system. Additionally, performance tracking is implemented to monitor the service.

Development of an Information Service System for Customers via Online Channels (Chat-bot)

The company has developed a customer service system through online channels such as LINE and Facebook to provide convenience and enhance speed. It can provide information about the company’s product details, frequently asked questions, offer application usage guidance, and information about nearby branches, all in a convenient manner.

This system helps reduce operational costs and increases service efficiency, reflecting the use of technology to enhance the company’s business competitiveness. It enables quick services and effectively meets customer needs. Additionally, it promotes sustainable and cost-effective operations, supports efficient resource management, and boosts the company’s competitive capabilities. In 2024, it was found that there were a total of 431,280 accounts using the Chat-bot to inquire for information.