To achieve good corporate governance, the company must have a good structure and business management system, as well as a strong relationship between the board of directors, management, shareholders, and other stakeholders, so that business can be conducted with transparency and verifiable compliance, treating stakeholders equitably, transparent disclosure of information, responsibility for duties, and accountability for performance. Good corporate governance can increase the value of a company, boost investor confidence, increase competitiveness, encourage shared values among stakeholders, and avoid negative environmental effects in both the short and long term.

Corporate Governance

Good corporate governance

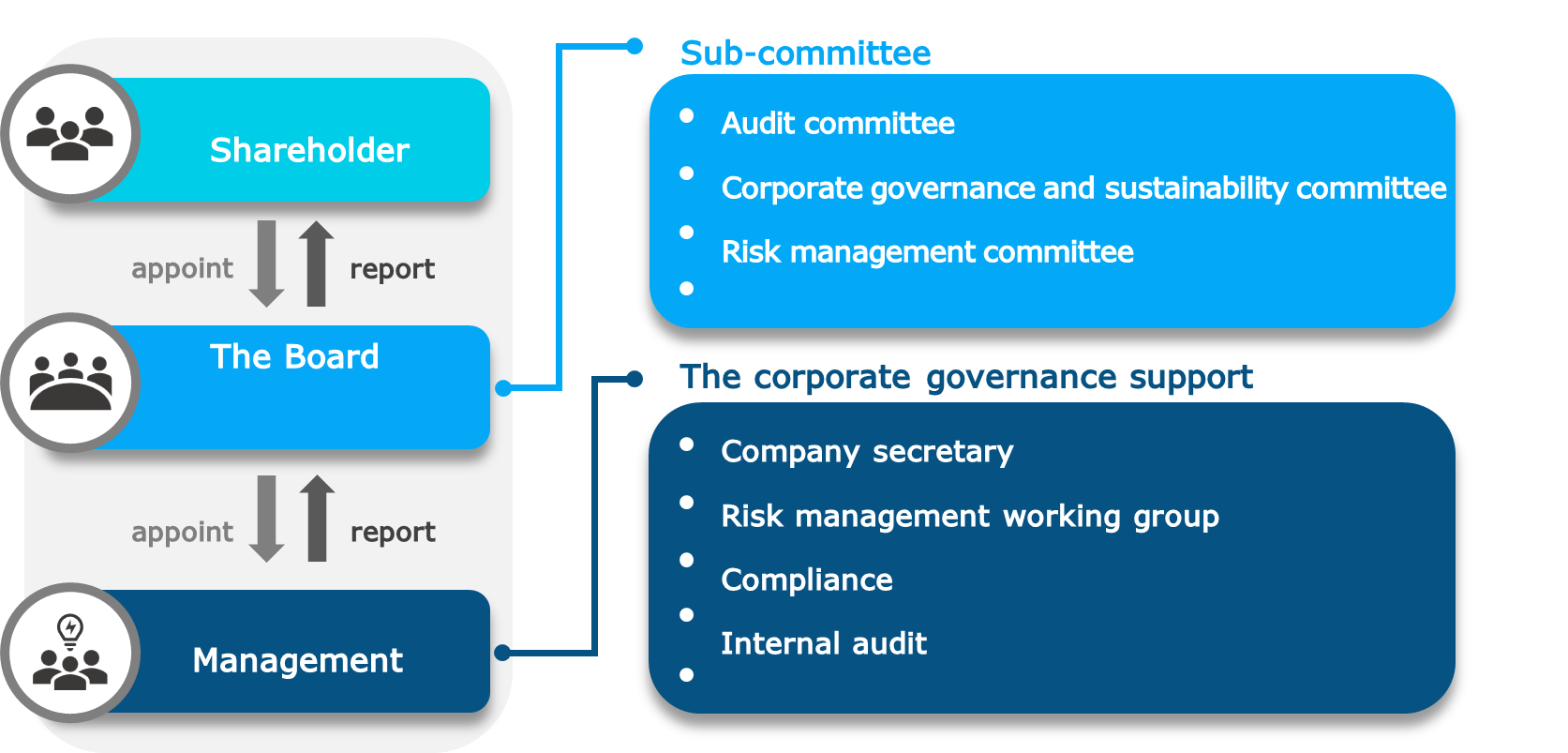

1. Corporate Governance Structure

The structure consists of shareholders, the board of directors, and management. Shareholders have the right to own the business through the appointment of the board of directors to operate on their behalf and have the authority to make decisions about significant changes to the company. The Board of Directors represents the shareholders in determining the organization's direction and appointing and supervising. Management comprises individuals with the vision, knowledge, ability, and ethics to lead the company and meet stakeholders' expectations.

1.1 Shareholders

Shareholders own the company by appointing the board and making key decisions. Guidelines promote the exercise of rights, reflecting respect for fundamental shareholder rights. This ensures transparency, accountability, and long-term value for shareholders. The company remains committed to upholding these principles.

Shareholder benefits

✓ Buying/selling/transfer of shares.

✓ Shareholder meeting

✓ Appointment/demotion/determine the remuneration for the board directors

✓ Appointment/determine the remuneration for auditor.

✓ Vote in approval at the meeting

✓ Acknowledge important corporate information and news accurately, completely, sufficiently, and on time.

✓ Expressing opinions and asking questions.

Shareholders meeting

The annual general meeting of shareholders will be held within four months of the end of the fiscal year of the company. However, if there is an urgent need to consider special agendas that could affect or relate to the interests of shareholders, requiring shareholder approval, the board of directors may convene an extraordinary meeting of shareholders on a case-by-case basis.

In organizing this Annual General Meeting of Shareholders, the company has complied with the guidelines of the quality assessment program for the Annual General Meeting of Shareholders (AGM Checklist) prepared by the Thai Investors Association to ensure that the organization meets the standards according to the principles of good corporate governance as follows:

- The company must send documents to shareholders to acknowledge the date, time, venue, and agenda. As well as all relevant information to all shareholders at least 30 days in advance and must be published on the company's website before being delivered to Thailand Securities Depository Company Limited, the company's share registrar. Invitation letter to the shareholders' meeting and supporting documents to all shareholders at least 7 days in advance of the meeting date.

- The company must allow shareholders to submit questions in advance of the meeting date during October–December of every year and according to the criteria set by the company, which are published on the company's website at www.muangthaicap.com.

- If shareholders are unable to attend the meeting in person, the company allows shareholders to appoint an independent director or any person as their proxy to attend the meeting on their behalf and to nominate at least one independent director as an alternative for the proxy of shareholders.

- The company does not change or add agenda items without informing stockholders in advance.

- The Board of Directors encourages the use of voting cards for every agenda, including the agenda for the appointment of individual directors for transparency and accountability.

- The company shall facilitate shareholders to fully exercise their rights to attend and vote by holding meetings on business days at hotels in Bangkok or the company's meeting rooms. Provide sufficient technology for document verification and stamp duty for shareholders who are proxies.

- The company prepared separate ballot papers for each agenda for the convenience of voting and vote counting and announced the total votes immediately on the meeting day.

- The company takes no action that would deprive stockholders of their right to attend meetings. Every shareholder has the right to attend the meeting and ask questions throughout the meeting time. as well as freely express opinions.

- When the meeting begins, the directors, including executives, auditors, and independent legal advisers. Before the meeting begins, the company will clarify all meeting-related rules, such as the meeting's opening and voting, as well as how to count the votes of the shareholders who are required to vote on each agenda according to the company's regulations.

- The company specifies the interests of the directors in the meeting invitation letter. If any director has stakes or involvement in any agenda. The chairman of the meeting or the company secretary will inform the attendees before considering the agenda. Directors with vested interests will not attend the meeting on that agenda.

- The company allows shareholders to volunteer to act as witnesses in vote counting for transparency, as well as allowing shareholders to inquire about the voting process and method.

- Encourage meeting attendees to exercise their rights to protect their interests by asking questions, expressing their opinions, giving suggestions, and jointly voting on important matters that may affect the company, such as appointments or removal of directors, nominating a person to be an independent director, approval of appointment and remuneration of auditors, dividend allocation, reduction, or capital increase. Determination or amendment of the company's Articles of Association, Memorandum of Association, and approval of special transactions, etc.

- Arrange for an assessment of the quality of meeting preparations based on the responses to the shareholder evaluation form to improve the efficacy of meeting preparations to make them more efficient, transparent, and beneficial to shareholders.

- Display important company information around the shareholder meeting, including establishing an investor relations area where company officials greet and answer various questions from shareholders.

In 2024, the company organized a shareholder meeting through electronic media (E-AGM), which was broadcast from the “Suk Samakkee” Conference Room at Muang Thai Capital Public Company Limited, located at 332/1 Charansanitwong Road, Bang Phlat, Bang Phlat District, Bangkok. At the beginning of the meeting, the following shareholders attended the meeting:

Shareholder attend through electronic media

26

Persons

Total

728,935,562

Shares

Proxies’ Attended

1616

Persons

Total

377,373,468

Shares

Total

1642

Persons

Total

1,106,309,030

Shares

Calculated as 52.18%

At the 2024 Annual Shareholders' Meeting, financial statements, profit allocation, and dividend payments were approved, along with the reappointment of directors who retired after their terms of office, namely Mrs. Kongkeaw Piamduaytham and Mrs. Nongnuch Dawasuwan, to return to their positions as directors. Additionally, the meeting considered, approved, and determined directors' remuneration, taking into account their responsibilities and the company's operating results. The appointment of auditors was also approved, along with the determination of audit fees. Furthermore, the meeting approved the issuance and offering the debentures in the amount of 15,000 million baht.

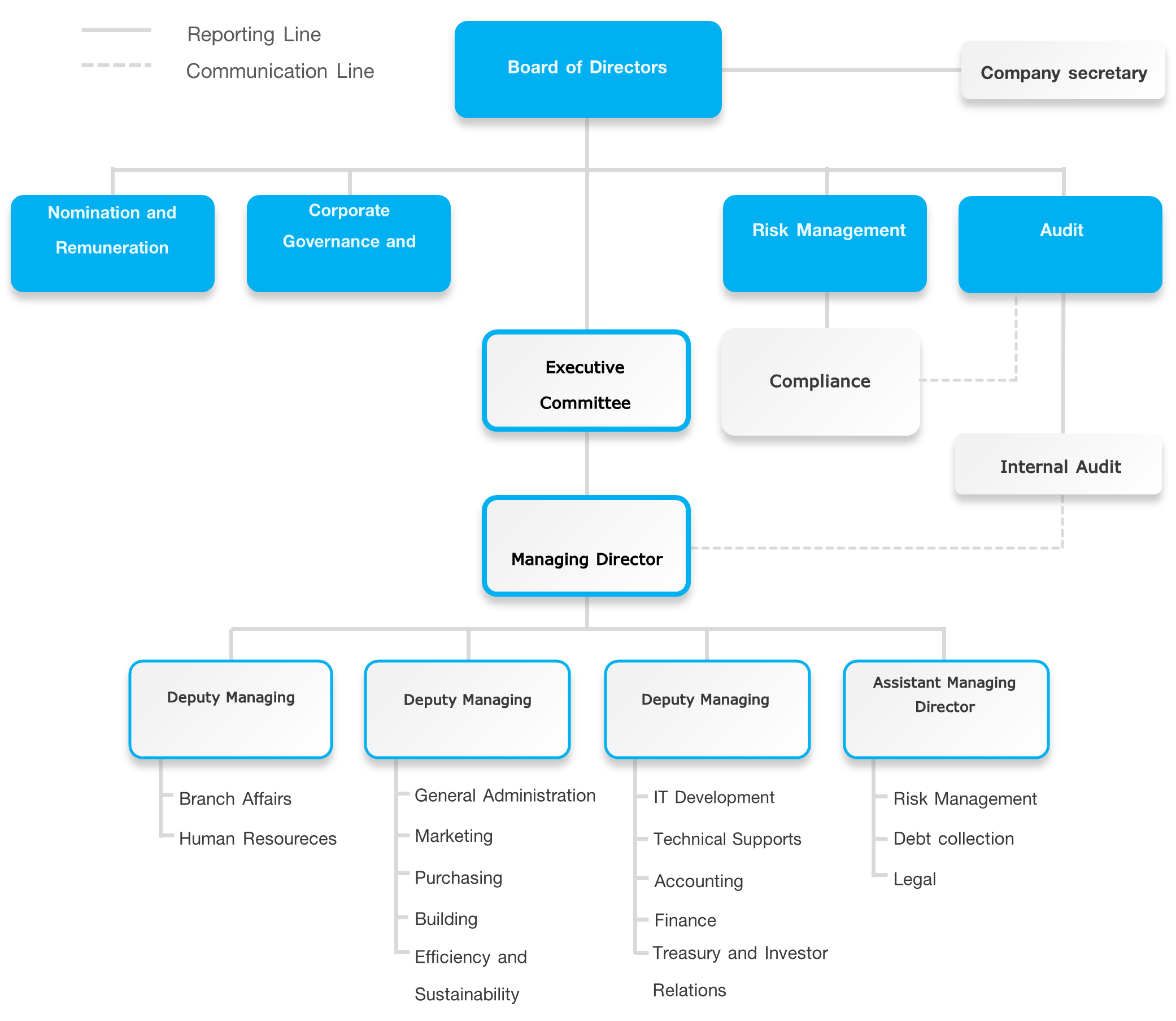

1.2 The Board of Directors

The Board of Directors was elected by the shareholders to oversee all aspects of the company's operations, including directing, approving, and ensuring that the business is as planned. Furthermore, the board of directors is responsible for selecting the Chief Executive Officer along with other high-ranking executives as well as ensuring efficient succession.

Based on these duties, the company has a strategy of selecting directors with diverse experiences and abilities, as well as the required qualifications such as honesty and professionalism, as well as the ability to ask questions for an analytical understanding of the company's business independently.

In addition to stipulating that the chairman is not a senior executive, the chairman must also be an independent director to ensure that checks and balances between the Board of Directors and the management are appropriately established. In addition, the Board of Directors has separated the roles and responsibilities of the executives.

Appointment, election and removal of directors

- The shareholders, by resolution of the shareholders' meeting, determine the number of persons who will hold the position of the Company's directors from time to time. The number of directors shall not be less than 5 persons, with not less than half of the total number of directors must reside in Thailand and having Thai nationality as required by law.

- Voting for the election of directors shall follow the rules and procedures stipulated in the Company's regulations.

- The person who is a director can only be appointed or withdrawn by the shareholders in the shareholders' meeting, except cases of vacancies arising from reasons other than retirement by rotation.

- The shareholders' meeting may pass a resolution removing any director from office before the expiration of the term with a vote of not less than three-fourths of the number of shareholders attending the meeting and having the right to vote. And the total number of shares held is not less than half.

For the selection of the Board of Directors, the Nomination and Remuneration Committee will consider selecting individuals with the ability and appropriate qualifications based on the criteria for recruitment and appointment. These criteria are determined by the absence of prohibited characteristics according to laws and regulations, as well as considerations for Board Diversity, including factors such as gender, race, nationality, skin color, ethnicity, and religion. Additionally, the Committee will consider the knowledge and specialized expertise (Board Skill Matrix) beneficial and consistent with the Company's business operations, such as accounting, management, strategy, human resource management, technology and information systems, and risk management, to promote appropriate diversity within the board consistent with the board's diversity policy. The Nomination and Remuneration Committee will propose the names of selected individuals to the Board of Directors for consideration and appointment.

he Nomination and Remuneration Committee has reviewed the criteria for nomination of directors and the Board Skill Matrix annually to ensure that the Board of Directors has a variety of elements according to best practice.

Qualifications of Directors

- Complete qualifications and no prohibited characteristics according to relevant criteria

and laws, including:

- - Public Limited Companies Act

- - Securities and Exchange Act

- - The Office of the Securities and Exchange Commission

- - The Securities Exchange of Thailand

- - Company's regulations

- - Principle of good corporate governance

- Knowledge, skills, and experience that can be helpful and appropriate to the nature of the business's operations

- Perseverance and ability to fully devote time to perform duties according to their responsibilities. The recruitment of senior executives and recruitment of directors must strictly comply with the rules of relevant laws and regulations of regulatory bodies with regard to qualifications with knowledge and competency appropriate to the culture, mission, vision, and values of the organization. The nomination of directors will have a clear and transparent process. And following the principles of good corporate governance can be examined.

As of December 31, 2024, there are 7 directors as follows:

1. Adm. Apichart

Pengsritong

Independent Director / Chairman of the Board of Directors / Chairman of the Nomination and Remuneration

2. Mr. Chuchat

Petaumpai

Director / Risk Management Committee / Chairman of the Executive Committee

3. Mrs. Daonapa

Petaumpai

Director / Managing Director

4. Mrs. Kongkaew

Piamduaytham

Independent Director / Chairman of the Audit Committee / Chairman of the Corporate Governance Committee

5. Mrs. Nongnuch

Dawasuwan

Independent Director / Audit Committee /Risk Management Committee / Corporate Governance Committee

6. Mr. Suchart

Suphayak

Independent Director / Chairman of the Risk Management Committee Audit Committee / Corporate Governance Committee / Nomination and Remuneration Committee

7. Mr. Suksit

Patcharachai

Director / Nomination and Remuneration Committee / Corporate Governance Committee / Risk Management Committee

The board is divided into 4 males and 3 females. The Chairman of the Board is an independent director, distinct from the company's leader (CEO). The proportion of directors can be explained as follows:

Independent Directors 4 persons

representing 57.14 %

Executive Directors 2 persons

representing 28.57 %

Non-Executive Directors 5 persons

representing 71.43 %

Independence of the board of Directors from the management

The Board of Directors shall consider, express opinions and vote on matters for which the Board of Directors has decision-making powers. If the directors are under pressure from the position or family or have interests, it will distort the decision to judge in favor of oneself, one's close friends, or for one's own benefit. Therefore, the independence of directors is a matter of great concern to protect the interests of shareholders. Directors who lack independence should not be responsible for making decisions.

The Board of Directors and the management have separated roles, duties, and responsibilities to enable checks and balances and review of management. The Board of Directors will consider and approve the overall policy such as vision, mission, operational strategy, corporate governance policy, and overall financial objectives to achieve the objectives and goals, including monitoring, evaluating, and overseeing the reporting of performance, while management is responsible for administering the policies set by the Board of Directors.

Qualifications of independent directors

- Holding shares not exceeding 0.5 percent of the total number of shares with voting rights of the Company and its subsidiaries.*

- Not being or used to be a director who takes part in management or an advisor who receives a regular salary or controlling person of the company.*

- Not being a person related by blood or by legal registration of an executive or controlling person

- Not having or never having a business relationship and shareholders of the company or controlling person* in a manner that may interfere with his independent judgment

- Not being or used to be an auditor and a significant shareholder of the company's audit firm or a controlling person.*

- Not being or having been a professional service provider and a significant shareholder, including legal and financial advisory services, receiving service fees of more than 2 million baht per year from the company or a controlling person

- Not being a director who has been appointed as a representative of the company's directors, major shareholders, or shareholders who are related to major shareholders

- Not operating a business of the same nature and in significant competition with the Company's business, or not being a significant partner or a director involved in employee management. Advisors who receive a regular salary or hold more than 1% of the total number of voting shares of a company engaged in a business of the same nature and in significant competition with the Company or it subsidiaries.

* Unless he or she has retired from such a position for at least 2 years. Such prohibited characteristics do not include the case where the independent director used to be a civil servant or advisor to a government agency who is a major shareholder or a controlling person.

Roles and responsibilities of the board of directors

- Have the authority and responsibility to manage following the law, objectives, and regulations, as well as the resolutions of the shareholders' meeting with honesty and carefulness to protect the interests of the company.

- Prepare an annual report, balance sheet, profit-loss statement at the end of the accounting period to present to the shareholders' meeting for consideration and approval to show the financial status and operating results of the previous year.

- Set the vision, mission, policy, strategy, and goals of the Company. And to consider and approve the direction of business operations for the management to use in preparing business plans, support plans, and annual budgets.

- Arrange for independent discussions and opinions of the management to determine the direction of the organization and be prepared to cope with situations that may change in economic conditions and other environments.

- Continuously follow up on the operations following the policy and budget plans.

- Set up an appropriate and efficient accounting system, financial reporting, and reliable auditing, including setting up an internal control system and an internal audit system that is sufficient and appropriate.

- Establish a risk management policy to cover the entire organization and supervise the establishment of a system or process for risk management with supporting measures and control methods to reduce the impact on the company's business appropriately.

- Determine policies on social, community and environmental responsibility, including providing guidelines for the Board of Directors, executives and employees to strictly follow.

- Determine the management structure, and have the authority to appoint and determine the scope of authority and duties of the Executive Committee, Managing Director, and other sub-committees as appropriate.

- Annual performance appraisal of the Chief Executive Officer (CEO).

Board meeting

- Arrange regular meetings of the Board of Directors of the company for acknowledgment of the Company's operating results at least once every three months and may have additional special meetings as necessary. The agenda of the meeting is set and the meeting notice is sent 7 days in advance, and the minutes of the meeting are recorded, stored, certified, and verifiable.

- Arrange for a discussion meeting among non-executive directors at least once a year to allow them to discuss strategies and operations of the company independently of the management.

- The Chairman of the Board of Directors and the Chairman of the Executive Committee have to jointly set the agenda of the meeting by allowing other directors to participate in their consideration before adding the agenda and sending the meeting invitation.

- Directors have to attend the meetings, with the attendance of at least 75 percent of the annual meeting and the minimum quorum not less than two-thirds.

- Minutes of the meeting shall specify the date and time of the beginning and end of the meeting, the names of the directors who attended and those who did not, the conclusions of the agenda, the issues discussed, and the recommendations of the Board of Directors. This shall include detailed explanations of the management and resolutions of the Board of Directors, along with the signature of the chairman of the meeting. If any director is a stakeholder on any agenda item, he or she shall not participate in the consideration and shall abstain from voting on that resolution. The Company Secretary shall inform all directors of this before the meeting.

- Minutes of the meeting will be copied and sent to relevant internal and external departments within the specified period and can be stored as a reference document and verifiable. Meeting minutes cannot be edited without approval from the meeting.

In 2024, a total of 10 Board of Directors meetings were held. The attendance rate of the Board of Directors meetings is 85.71%.

Sub-committee

The Board of Directors has appointed sub-committees to help scrutinize important matters, comprising the Audit Committee, the Corporate Governance and Sustainability Committee, the Risk Management Committee, and the Nomination and Remuneration Committee. Management will adhere to the objectives, goals, and policies set by the Board of Directors. Additionally, there will be a unit to support the corporate governance system, namely the company secretary, risk management unit, compliance unit, internal audit, and organizational development for sustainability.

Role and responsibilities of Audit Committee

- Review to ensure that the Company has accurate quarterly and annual financial reports and adequate disclosure of information to ensure equality of shareholders.

- Review of the Company has a risk management system, internal control system, internal audit system is appropriate and efficient and considers the independence of the internal audit unit as well as approves the appointment, transfer, termination of employment, and assessment of the performance of the head of the internal audit unit or other agencies responsible for internal audits.

- Review the Company's compliance with the Securities and Exchange Act, requirements of the Stock Exchange and laws related to the Company's business.

- Review the Company's operations to ensure compliance with the policy of the Private Sector Collective Action Coalition Against Corruption.

- Consider transactions that may have conflicts of interest to comply with the laws and regulations of the Stock Exchange of Thailand.

- Review and consider the major risks detected by the management, including giving suggestions for improvements.

- In compliance with the scope of powers and duties, the audit committee has the power to invite or order the management or supervisors to attend a meeting to clarify or submit relevant documents.

- Prepare the Audit Committee's report to be disclosed in the Company's annual report. The report shall be signed by the Chairman of the Audit Committee.

- Consider, select, nominate, appoint and propose the Company's auditors' remuneration which is independent to act as the Company's auditor, including attending a meeting with the auditor at least once a year.

- Consideration on the independence of the audit department and offer comments to the management regarding appointments, transfers, terminations, internal audit office managers, as well as evaluate performance, budgets, and staffing levels of the internal audit department.

- Consider and approve the internal audit department’s charter implementation plan and performance appraisal agreement.

- Review the Audit Committee charter at least once a year.

- Perform other acts as required by law and assigned by the Board of Directors and related operations to achieve the objectives of the Audit Committee.

- Receive complaints, report clues, the act of corruption both inside and outside at the director executives or employees of the Company involved.

- Audit the Company's operational practices to ensure compliance with laws/regulations/directives mandated by regulatory and supervisory agencies, such as the Debt Collection Act, Personal Data Protection Act.

- Review and ensure compliance with environmental regulations and policies related to the company's operations.

- Review and assess the effectiveness of the Company's corporate governance practices, ensuring alignment with best practices and regulatory standards.

Role and responsibilities of Nomination and Remuneration Committee

Nomination

- Establish criteria and policies for selecting company directors and sub-committee members, considering the appropriate number and structure of the board and the qualifications of directors, to propose to the board or seek approval at shareholder meetings as required.

- Review, select, and propose suitable candidates to fill vacant or newly created positions on the company's board of directors.

- Organize elections for directors.

- Carry out other tasks related to recruitment as delegated by the board of directors.

- Evaluate the performance of top executives and present recommendations for approval at board meetings.

- Regularly review the criteria for director selection and the Board Skill Matrix to ensure a diverse range of skills in accordance with best practices. Remuneration

Remuneration

- Prepare criteria and policies for determining the remuneration of the Board and sub-committee to propose to the Board or propose for approval at the shareholder’s meeting as appropriate.

- Set appropriate remuneration both monetary and non-monetary, for individual Board member by considering duties, responsibilities, ESG performance compared to similar businesses. Proposals should be presented to the Board for consideration and then propose the shareholders’ meeting for approval.

- Responsible for the Board of Directors and responsible for providing clarification and answering questions about remuneration for directors at the shareholders’ meeting.

- Report on policies, principles and rationale for determining the remuneration of directors and executives, in accordance with the regulations of the SET, by disclosing in the annual registration statement (56-1 One Report) of the Company.

- Perform other duties as assigned by the Board of Directors. The Management and related departments are responsible for reporting relevant information to the Nomination and Remuneration Committee to support its performance to achieve the assigned duties.

Role and responsibilities of Corporate Governance and Sustainability Committee

To achieve sustainability for all stakeholders, the company established the "Corporate Governance and Sustainability Committee" to manage the business under good governance while considering the organization's sustainability in various dimensions. This includes annually monitoring and evaluating environmental, social, and economic (ESG) operations to create value for the company as well as the Group of Companies' operations in the same direction.

- Establish sustainable development goals, policies, and action plans for the company, covering both sustainable organizational development and long-term value creation for stakeholders.

- Establish a policy for corporate governance and business ethics, and present it to the board for approval. Provide guidance, promote, and review the policy regularly to ensure its compliance with laws and best practices at the international level. Additionally, oversee performance evaluations and regularly report on policy implementation.

- Suggest and enhance conducting business relating to corporate governance and sustainable development to meet the goal, be equal with the leading companies.

- Consider proposing good practices in relation to corporate governance for the Committee or propose the determination of the Committee's regulations on such matters to be in accordance with the universal guidelines and suggestions of the regulatory institutes.

- Supervise, evaluate, and review the sustainability goals, policies, and development plans of the company to ensure they are aligned with the business environment, aiming to maximize benefits for the company and stakeholders.

- Examine and review the goals, policies and process plans of sustainable development to be suitable with the state of conducting business.

- Conduct regular reviews of corporate governance policies and sustainable development practices.

- Review the company's board charter on an annual basis.

- Review policies and monitor compliance with measures to combat corruption and ensure transparency, integrity, and anti-corruption practices in all aspects of the company's operations.

- Oversee the disclosure of corporate governance and sustainable development information to stakeholders through the 56-1 One Report and sustainability reports.

- Promote a culture of good corporate governance and social responsibility, encouraging participation in community activities.

- Report the progress and results of corporate governance and sustainable development efforts to the company's board of directors.

Role and responsibilities of Risk management committee

- Establish and review the corporate risk management framework policy.

- Supervise and support the implementation of enterprise risk management in line with strategies and business goals, including the changing circumstances.

- Review the organization's risk management report and provide comments on potential risks that may occur, including proposing control measures or mitigation plans, and developing the organization's risk management system for implementation by the risk management team or department to ensure continuous efficiency.

- Present the results of the organization's risk management to the company's board of directors for acknowledgement. In cases where some significant factors or events may have a significant impact on the company, they must be reported to the board of directors promptly for awareness and expedited consideration.

- Establish the risk management policy and define the acceptable risk tolerance levels for the company. Present these to the board of directors for overall risk management consideration. This must encompass various types of risks such as strategic risks, liquidity risks, market risks, operational risks, or any other significant risks to the company.

- Define the organizational structure and resources used in risk management to align with the company's risk management policy. This should enable effective analysis, assessment, measurement, and monitoring of risk management processes.

- Supervise, review, and provide recommendations to the board regarding risk management policies, standardized practices, strategies, and overall risk measurement to ensure that risk management strategies are implemented appropriately.

- Perform any other duties assigned by the Board of Directors.

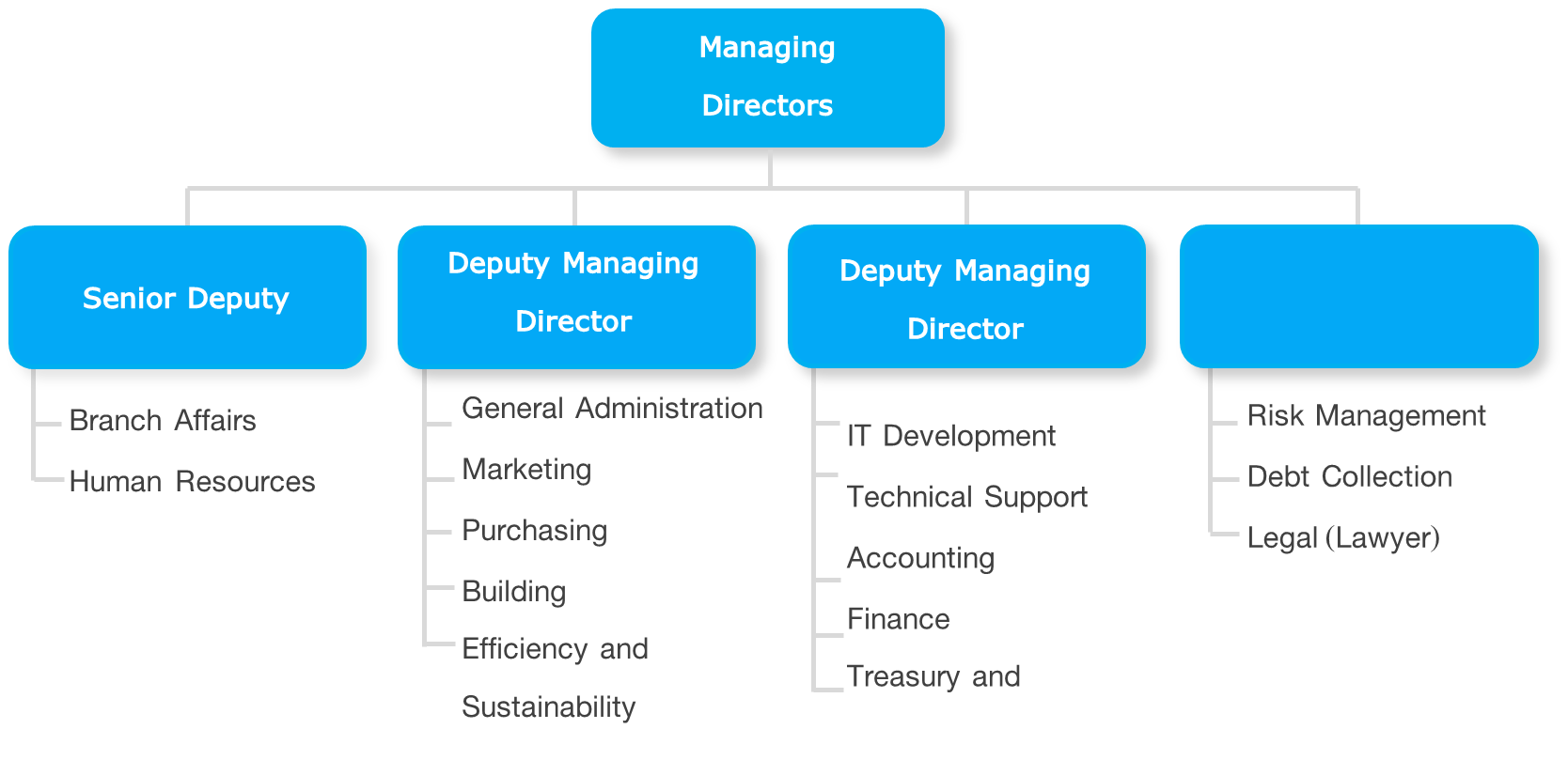

1.3 Management

The management is responsible for managing various areas following the policies, strategies, and goals set by the Board of Directors.

Roles and responsibilities of management

- Propose goals, policies, and business plans including the annual budget of the Company to the Board of Directors for approval.

- Supervise the Company's business operations following the policies, plans, and budgets approved by the Board of Directors.

- Consider and approve operations that are business transactions of the Company, such as various investments according to the investment budget or the budget approved by the Board of Directors, etc., with the amount of money for each transaction according to the approved authority table from the Board of Directors.

- Consider approving the determination, amendment, and change of rules and regulations regarding credit approval, and credit schedule, including setting and amending fines and discounts.

- Propose an organizational structure suitable for the Company's operations to the Board of Directors. Including considering approval of manpower rates that are not in the annual budget.

- Consider the profits and losses of the company, interim dividend, or annual dividend payment proposal to the Board of Directors.

- The power to appoint or hire a consultant Related to the management within the company to achieve maximum efficiency.

- Authorize the authorization of one or more persons to perform any act under the control of the Executive Board or may authorize such person to have power as the Executive Board deems appropriate. Appropriate and within a period of time that the Executive Committee deems appropriate. The executive committee may cancel, revoke, change or amend the authorized person or authorization as appropriate.

- Perform other duties as assigned by the Board of Directors.

2. Preparation of good corporate governance policies and guidelines

In 2024, the Board of Directors continually reviewed and improved the policy and monitored performance according to the good corporate governance plan, including the community, social, and environmental responsibility plan, at least once a year in line with the Principles of Good Corporate Governance for Listed Companies 2017 or the Corporate Governance Code (CG Code) by the Securities and Exchange Commission (SEC), which consists of:

- Realize the roles and responsibilities of the Board as a company leader that creates sustainable value for the business (Establish Clear Leadership Role and Responsibilities of the Board).

- Determine objectives and main goals of sustainable business. (Define Objectives that Promote Sustainable Value Creation).

- Adhere to fairness by treating all stakeholders equally and supervising, controlling, and preventing any decisions or actions that have conflicts of interest and related transactions based on the interests of the company.

- Recruitment and development of high-level executives and personnel management (Ensure Effective CEO and People Management).

- Promote innovation and responsible business operations (Nature Innovation and Responsible Business).

- Ensure that there is an appropriate risk management and internal control system (Strengthen Effective Risk Management and Internal Control).

- Maintain financial credibility and information disclosure (Ensure Disclosure and Financial Integrity).

- Encourage engagement and communication with shareholders (Ensure Engagement and Communication with Shareholders).

The Board of Directors has established policies and guidelines for corporate governance of the Company, which are divided into 3 groups, namely policies and guidelines for directors and executives, Policies and guidelines for organizational management, and policies and guidelines for stakeholders.

2.1 Policies and guidelines for directors and executives

The Board of Directors has established the corporate governance policy and business ethics for directors, executives, and employees as guidelines for all stakeholders. Announcements and communications have been made to employees for their acknowledgment, including disseminating them on the Company's website to provide employees of the Company and related parties with knowledge and understanding of corporate governance principles in the same direction by adhering to transparency, fairness, accountability, and ethics in business operations. There is a practice that is consistent with the rules, regulations, and relevant laws. as well as being responsible for the economy, society, and the environment by setting guidelines to be a framework for operating and treating all stakeholders as the following:

- Dedicated to applying the principles of good corporate governance and ethical practices in conducting the business operations of the company, as well as fulfilling duties following laws, regulations, and relevant requirements to sustainably create value for the company.

- The Board of Directors must play a pivotal role alongside the management in setting the company's vision, strategy, policies, and critical plans. This includes establishing a governance structure that is fair and interconnected among the board, management, and shareholders. It involves laying out management guidelines and business practices that are appropriate and aligned with the company's objectives.

- The Board of Directors has to review and approve the vision, strategy, policies, and practices of good corporate governance regularly to enhance the effectiveness of governance and elevate governance standards appropriately in response to changes.

- The Board of Directors must collaborate closely with the management in communicating and ensuring compliance with the vision, strategy, policies, and practices of good corporate governance to ensure that employees are informed and adhere to them rigorously.

- Directors and executives must lead by example in matters of ethics and serve as role models in fulfilling their duties with honesty, integrity, and fairness, subject to transparent scrutiny.

- All directors, executives, and employees must uphold the principles of good corporate governance as integral values of the organization. This involves treating all stakeholders equally, while actively overseeing and preventing conflicts of interest to prioritize the company's best interests.

- All directors, executives, and employees must steadfastly adhere to and implement the anti-corruption policy, refraining from intellectual property infringement, respecting laws and human rights, and ensuring an effective anti-corruption system is in place. This ensures everyone is aware of and prioritizes compliance with the anti-corruption policy.

- The board of directors must establish appropriate internal control and risk management systems, including reliable accounting and financial reporting systems.

- Directors, executives, and employees must instill ethics, morality, and a strong conscience, treating employees fairly and continually striving to develop and enhance their abilities.

- The company's management structure must include good corporate governance, clearly defining the roles and responsibilities of each committee and manager.

- All directors, executives, and employees must act responsibly towards shareholders, stakeholders, communities, society, and the environment.

- Directors, executives, and employees must be conscious of and equally respect the rights of shareholders.

- Everyone, including directors, executives, and employees, must strive for business excellence by prioritizing customer satisfaction through active listening, self-reflection, and continuous improvement to enhance management capabilities and consistently innovate.

- All directors, executives, and employees must ensure sufficient, trustworthy, and timely disclosure of significant information.

- Directors, executives, and employees must manage taxes efficiently, adhering to good ethical principles, effective tax risk management, and transparent disclosure to ensure maximum effectiveness.

- Upholding fairness means treating all stakeholders equally, overseeing, controlling, and preventing any decisions or actions that may pose conflicts of interest or compromise the integrity of the organization, along with interconnected items. This responsibility lies with all directors, executives, and employ

2.2 Policies and guidelines for organizational management

1. Risk Management

- Create a risk form in line with a comprehensive management process.

- Organize workshops for all sectors to participate in risk determination

- Preparation by conducting risk operations with simulations.

- Review risk management, following the company's vision and goals.

- Monitoring and evaluating the results of risk management following the management plan.

- Arrange for reports on the results of risk management at all levels and all departments at least twice a year.

- Promote a culture of risk management and appropriate internal control in all departments of the organization.

2. Internal Control

- Establish appropriate internal control systems and efficient accounting and financial reporting systems.

- Proceed to ensure that the company's management structure has good corporate governance by clearly defining the duties and responsibilities of each committee and executive.

- Providing reliable financial reports and auditing, as well as providing an internal control system and an internal audit system that is sufficient and appropriate.

- Review the company's internal control and internal audit system to ensure suitability and efficiency.

3. Interrelated Transactions

- The company prescribes market prices or fair prices for all transactions.

- Directors must disclose information on transactions that may have conflicts of interest, connected transactions, or related transactions according to the regulations of the relevant authorities.

- Directors with related interests are prohibited from participating in the consideration of approval and in the case of connected transactions. Allow the Audit Committee to attend and give opinions following the principles of good corporate governance and the criteria of the Stock Exchange of Thailand.

- Granting credits or investing in businesses in which directors are involved must be approved by a unanimous resolution of the Board of Directors' meeting without the director participating in the approval process and must set prices and conditions. Following the bank's business practices and treating them as general customers.

4. Anti-Corruption

The company has joined the Private Sector Collective Action Coalition Against Corruption (CAC) and has been officially certified as one of the business practices in line with good corporate governance principles. The company has established guidelines for anti-corruption to instill it as part of the company's culture, as follows:

- Determine effective anti-corruption strategies.

- Provide whistleblowing channels that are easily accessible and have measures to protect the whistleblower.

- Transparent and fair audit process.

- Determine accurate, clear, and verifiable financial status reporting processes.

- Arrange an announcement showing the intention to oppose all forms of direct and indirect corruption.

- Provide training on good corporate governance, business ethics, and work practices.

- Refrain from giving gifts to executives or employees of the company at every festival.

5. Conflicts of interest

- Disclose and submit information about the company and its stakeholders to the Board of Directors.

- Avoid transactions that may cause conflicts of interest, and do not take any action that conflicts with the company's interests.

- Personnel must not attend the meeting or participate in an agenda that takes into account their interests.

- Expressing opinions or approving the agenda on matters in which they have an interest.

- Supervise and be responsible for ensuring that the company has an appropriate internal control system, a risk management system, and a fraud and corruption prevention system.

- The Board of Directors must supervise compliance with relevant laws and disclose information following related laws and notifications.

- Provide a working system with continuous and reliable disclosure of important information according to established rules. The Board of Directors and executives must report their interests related to the management when they first take office and report every time they change.

6. Whistleblowing

- All informed information is confidential and will not be disclosed to the public without consent.

- The details of clues or complaints must be reliable and clear enough to ascertain the facts for further action.

- The response time for complainants should not exceed 3 days after receiving the complaint.

- The processing time depends on the evidence received from the complainant and the explanations of the complainant, but not more than 30 working days.

- Those who report clues or complaints will be protected.

- Complaint recipients and fact-finding investigators must keep relevant information confidential and disclose it as necessary, taking into account the safety and damage of the complainant and all stakeholders.

- Keep the information and identity of the whistleblower, complainant, and the accused confidential.

- Disclose information only as necessary, considering safety and ensuring appropriate and fair remedies for affected parties.

- Refrain from any unfair actions against the whistleblower, complainant, or any involved parties.

- Complainants or those cooperating in fact-finding investigations may request the company to implement appropriate protection measures.

7. Intellectual property

- The company does not support actions that violate intellectual property rights. Any software used in the company's work system must be authorized and legally copyrighted.

- Employees must comply with all laws, regulations, and contractual obligations regarding valid intellectual property rights. Including patents, copyrights, trade secrets, and other proprietary information without violating the intellectual property rights of individuals.

- Employees who bring work or information belonging to third parties that have been acquired or are to be used within the company must be reviewed to ensure that they do not violate the intellectual property of others.

- Employees who use the company's computers must use the software according to the license of the copyright owner, and only those who have been authorized to use the company's software.

- Upon termination of employment, all intellectual properties, including works, must be returned to the company, regardless of the data stored in any form.

8. Public information disclosure

- Publicly disclose important information: Through the stock exchange website, company website or annual report.

- Disclosure of shareholding information: Including related transactions and interests of directors and executives.

- Deliver complete financial reports: Submit financial reports to the Securities and Exchange Commission within the specified timeframe.

- Appointment of auditors: The auditor's qualifications are not against the regulations of the Stock Exchange of Thailand and do not provide any other services to the company.

- Establish an investor relations unit: For example, holding analyst meetings and presenting information to domestic and foreign investors.

- Company's financial statements: Unconditionally certified by an auditor.

- Trading of the company's shares: Set a policy for directors and executives to notify the company at least 1 day before buying-selling shares.

- Disclosure of information about directors: Consists of position, education, holding company shares, work experience and photographs clearly stated.

- Disclosure of directors' remuneration: Clearly disclose the remuneration criteria for directors and executives in the annual report.

- Attach great importance to stakeholders: There is always a meeting, providing information, and exchanging ideas with stakeholders.

9. Responsible Lending

- The company operates under principles of corporate governance while addressing household debt issues to appropriate levels, adhering rigorously to the criteria set by the Bank of Thailand. This includes offering products tailored to customer needs, considering their ability to repay debts, and ensuring accurate and comprehensive advertising and information dissemination.

- Promoting financial discipline and providing financial management information to customers through various channels such as Line OA, Facebook, and the company's website to support customers in improving financial discipline and managing debts responsibly.

- The company sets up regular checks on operational practices in credit service provision to ensure compliance with relevant policies and regulations, along with preparing and delivering reports in formats and frequencies stipulated by the Bank of Thailand.

10. Money Laundering and Financing Terrorism (AML/CTF)

- The company has the right to establish or deny business relationships or transactions with

customers in cases where customers meet the following conditions:

- - The customers were identified as specified by the Anti-Money Laundering Office.

- - Conceal their real names, use aliases, use false names, provide false information, or present false documents.

- - Not receiving information or evidence that is crucial for identifying the identity of customers.

- The company requires customers to identify themselves every time before establishing business relationships or transactions to enable the company to identify and verify the identity of customers in accordance with the law, the criteria of the Bank of Thailand, and other relevant regulations through Know Your Client (KYC) and Client Due Diligence (CDD) procedures, both for face-to-face and non-face-to-face customers.

- Establishing relationships with customers must involve assessing the risk factors of customers, considering factors such as geographical location or country, products or services used, and the profession or status of customers, such as politically exposed persons (PEPs).

- The company has continuous processes to monitor and investigate the account activities of customers until the termination of business relationships, as mandated by legal guidelines, to assess whether customers' transactions align with the purposes, occupations, and disclosed sources of income or not.

- The company reports transactions as mandated by the Anti-Money Laundering Office, such as cash transactions and suspicious transactions, and tracks any transactions of related customers or those reasonably believed to be related to financing terrorism and proliferating weapons of mass destruction.

- The company mandates the storage of customer information, documents, identity verification, and transaction monitoring according to legal criteria.

- The company prohibits the disclosure of information or actions that may inform custom

- ers about identity verification or transaction reporting to the Anti-Money Laundering Office.

- The company mandates regular self-assessment of operational practices related to anti-money laundering and countering the financing of terrorism, such as reviewing company processes and transaction reporting systems, to ensure compliance with relevant policies and regulations.

2.3 Policy and Guidelines for Stakeholders

1. Policy and Guidelines for Shareholders

- The company respects the rights of shareholders, investors, and all creditors equally.

- The process of shareholders' meetings is organized to support the equal treatment of all shareholders.

- Supervise shareholders to receive equal treatment and protect their rights.

- There are measures to prevent directors and executives from using inside information for themselves or others in a wrongful way.

2. Policies and guidelines for creditors

- The company ensures that contracts with all types of creditors are legally binding, equitable, fair, and transparent, without exploiting any party involved.

- The company has a policy to strictly comply with the conditions, contracts, and commitments agreed upon with creditors.

- The company has never had any disputes regarding the default of payment, whereby the company has made payments to creditors following the agreed payment terms.

- In the case of being unable to comply with any of the conditions or causing a default in debt payment, creditors must be notified immediately without concealing the facts.

- Report accurate financial status and information to creditors.

3. Policies and guidelines for customers

- Provide a thorough assessment of the customer's ability to repay the debt.

- Develop and design credit products that meet customer needs.

- Implement proper marketing promotion and do not induce unnecessary debt.

- Develop communication channels with customers so that customers can make comments, complain, or provide services through other channels such as hotlines, emails, and social media, including the Whistleblower Channel application.

- Operate a business with responsibility for the rights of customers, and do not take any action that would infringe on their rights.

- Recognize the rights of customers' personal information by establishing a policy to protect personal information and the security of information systems as disclosed on the website.

4. Policy and Guidelines for Partners

- Do not request or receive or pay any dishonest benefits in trading with partners.

- Inform the business plan so business partners can know the number of products or services to be sold this year, including planning production and delivery to prevent subsequent problems.

- Strictly comply with the terms and conditions that have been agreed upon and pay the debts on time.

5. Policies and guidelines for business competitors

- The company operates within the framework of fair competition rules.

- Do not seek confidential information about business competitors through dishonest or inappropriate means.

- Do not damage the reputation of commercial competitors by making malicious accusations.

- Avoid entering into agreements with competitors in a manner that limits, monopolizes, or reduces competition in the market.

6. Policies and Guidelines for Regulator

- The company operates the business with a personal loan business license and a personal loan business license under the supervision of the Bank of Thailand. Including providing fair customer service (market conduct) and reporting information to relevant regulators to be accurate, transparent, and timely.

3. Follow up for implementation

The company has assigned the Corporate Governance and Sustainability Committee to regularly monitor and assess the performance of corporate governance by reporting progress and performance to the Board of Directors twice a year. As well as reviewing and proposing to the Board of Directors to consider revising the scope of duties and responsibilities of the Corporate Governance and Sustainability Committee following the situation.

4. Disclosure of the performance of the Board of Directors to stakeholders

The Board of Directors and all sub-committees must summarize their performance in the 56-1 One Report annually for transparency and assurance that the company's operations will achieve the objectives following the regulations of the unit and be able to create value for the company, which reflects the ability to do good corporate governance, social responsibility, and the environment, as well as creating value for all stakeholders.